Slashing migration will make Britons 'nearly £1,200 per year better off'

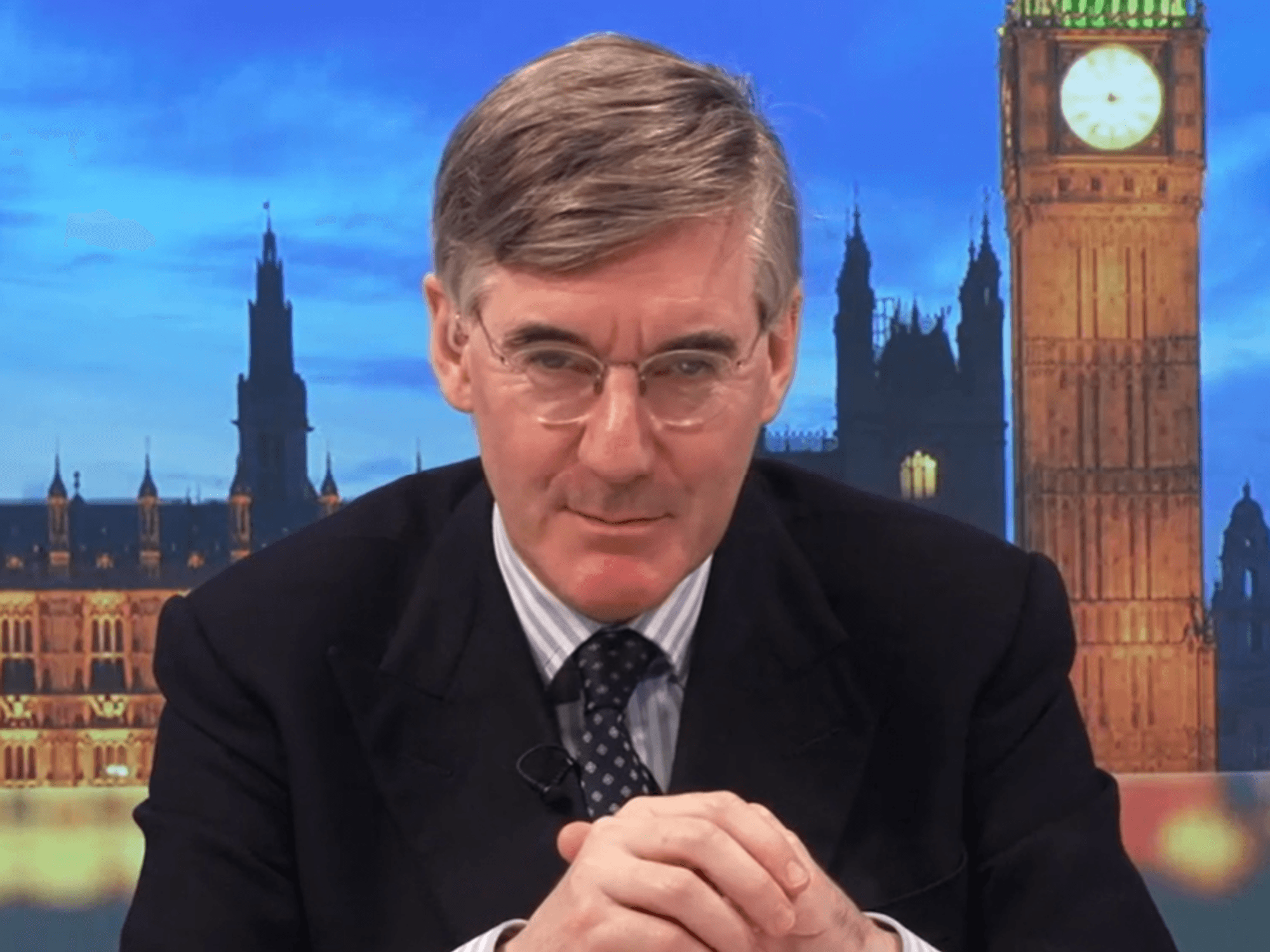

WATCH: Patrick Christys claims SHOCKING new migration figures 'will make people very nervous'

|GB News

Ex-Prime Minister Liz Truss launched the commission to help boost Britain’s economic growth

Don't Miss

Most Read

Britons could save more than £1,100 every year if net migration is reduced, new analysis suggests.

Research by the Growth Commission - which is set to be published this week - says slashing migration numbers will improve living standards over the long term.

The new analysis which comes ahead of the Spring Budget also found that scrapping inheritance tax would see a larger increase in per capita GDP than an equivalent cut to income tax.

Ex-Prime Minister Liz Truss launched the commission last year to investigate ways of boosting Britain’s economic growth.

Britons could save more than £1,100 every year if net migration is reduced, new analysis suggests | GETTY

Britons could save more than £1,100 every year if net migration is reduced, new analysis suggests | GETTYThe study modelled a reduction in Britain's annual net migration from 315,000 in 2028 to a figure of 150,000.

Researchers suggest the move would cut GDP by 2.4 per cent by 2045 but raise GDP per capita by 2.1 per cent by the same year.

Based on 2023 prices, this would be a £1,157 boost per person per year.

In conclusion, the group said high migration reduced per capita GDP as it increased the UK population - putting additional strain on the housing market.

LATEST DEVELOPMENTS:

As housing demand surges, prices increase which as a result slashes disposable income and the consumer power needed to stimulate the economy, researchers said.

Growth Commission co-chairman, Douglas McWilliams said that because Britain has an "especially degraded planning system", with excessive red tape "making house-building a nightmare", extra demand "largely goes into higher house prices rather than into new house-building as in other countries such as the US".

"We’ve tried to move the migration argument away from crude assertions on all sides to more carefully quantified estimates of its economic effects," he told The Telegraph.

"Ultimately the answer is to reform the planning system, but 3,240 pages of rules won’t be reformed overnight – which is why it makes sense to slow down net migration."

Research by the Growth Commission - which is set to be published this week - says slashing migration numbers will improve living standards over the long term

| PAThe Growth Commission also monitored how tax cuts would affect growth.

It found that decreasing corporation tax or removing inheritance tax would see a bigger boost than altering income tax.

Discarding inheritance tax would deliver a 1.4 per cent increase – a £757 boost – while cutting income tax by about 0.5p off the basic rate and similar amounts to the higher rates would deliver just a 0.3 per cent increase (£162).

McWilliams added: "Before we ran the analysis, I was not convinced that abolishing IHT [inheritance tax] was a good idea. But the research is pretty persuasive, showing that the tax has bad effects on savings, which leads to an exodus of high taxpayers and encourages early retirement.

"With an ageing population and with so many other countries with low or zero rates of inheritance tax, keeping this tax for purely ideological reasons looks to be a luxury the UK cannot afford."